Better Savings with Dollar Cost Averaging

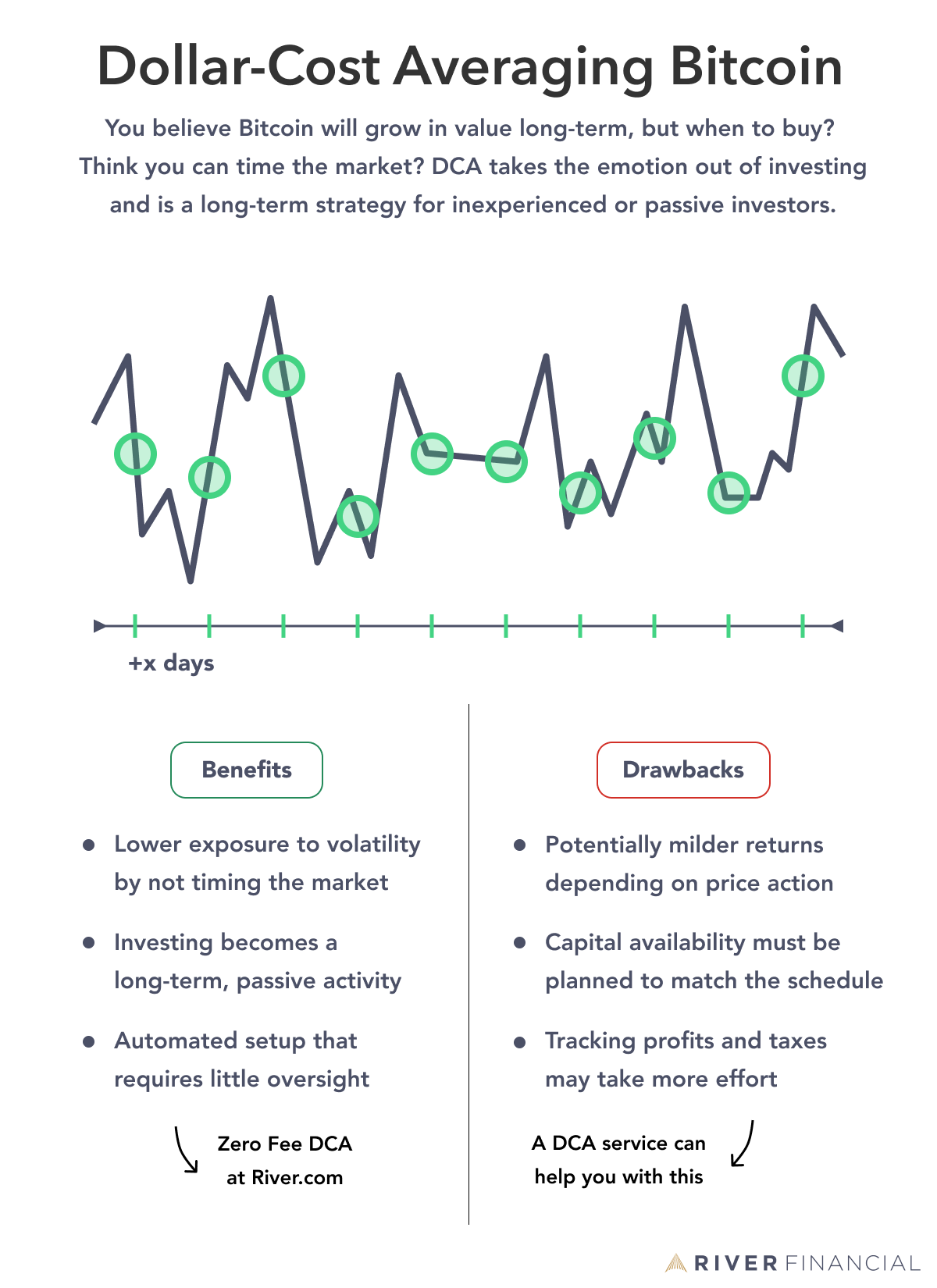

A long term strategy using the Dollar Cost Averaging (DCA) method to save during Bitcoin's volatile rise in value.

What is Dollar-Cost Averaging?

Dollar-cost averaging (DCA), also known as the constant dollar plan, is a long-term investment strategy in which an investor divides their planned total investment amount into periodic purchases. This spread reduces an investor’s exposure to short-term price volatility, as they gradually work towards their investment goal.

Dollar-cost averaging is typically done in an automated way, on a daily, weekly, bi-weekly or monthly basis. If an investor wants to invest $2500 in bitcoin for example, they could buy $50 worth per week for 50 weeks, instead of making this investment in one go. They would not be locked into this schedule and could stop buying or extend it as they please.

Many people around the world are already using a DCA strategy without realizing it. It is used in retirement plans and some health plans, as a way to invest in regular intervals based on paychecks.

Why Dollar-Cost Averaging in Bitcoin?

The goal of dollar-cost averaging is to take the emotion out of investing. It compels an investor to continue investing a fixed amount to reach their goal, regardless of short-term fluctuations and volatility in the market. DCA can help to avoid the temptation to time the market, which is notoriously difficult, even for the most experienced investors using sophisticated market analysis.

Adopting a DCA strategy requires some discipline and a long term outlook. It won’t always yield the best possible returns, but it does set an investor up for a growing bitcoin position over time.

Big Props and Atrribution goes out to Alex Leishman and the team over at River Financial for making great Bitcoin financial products for users in the U.S. Check out their full article on DCA at river.com.